The cryptocurrency market is rallying in anticipation that Republican candidate Donald Trump will win the US presidential elections as his lead continues to expand.

While that’s good news for the bulls, many short traders have been wrecked, with the single-largest being a whopping $75 million liquidation on Binance.

CryptoPotato has reported the live events transpiring on US soil as Trump’s chances to return to the White House as president continue to rise. As of writing these lines, the former POTUS has 247 electoral college votes against 214 for his Democratic opponent, Kamala Harris.

Being the self-proclaimed ‘pro-crypto’ candidate, Trump’s lead resulted in a somewhat expected surge for the digital asset market. Bitcoin led the charge once again, surging past its March all-time high of $73,737 (CoinGecko) and charting a new one at above $75,000.

Multiple altcoins have followed suit, with even more impressive double-digit gains, such as UNI (35%), DOGE (25%), POPCAT (24%), BONK (23%), WIF (21%), and many others.

The total crypto market cap has skyrocketed by over 7% and is up to $2.6 trillion now. These gains, though, have harmed over-leveraged traders, especially those with short positions.

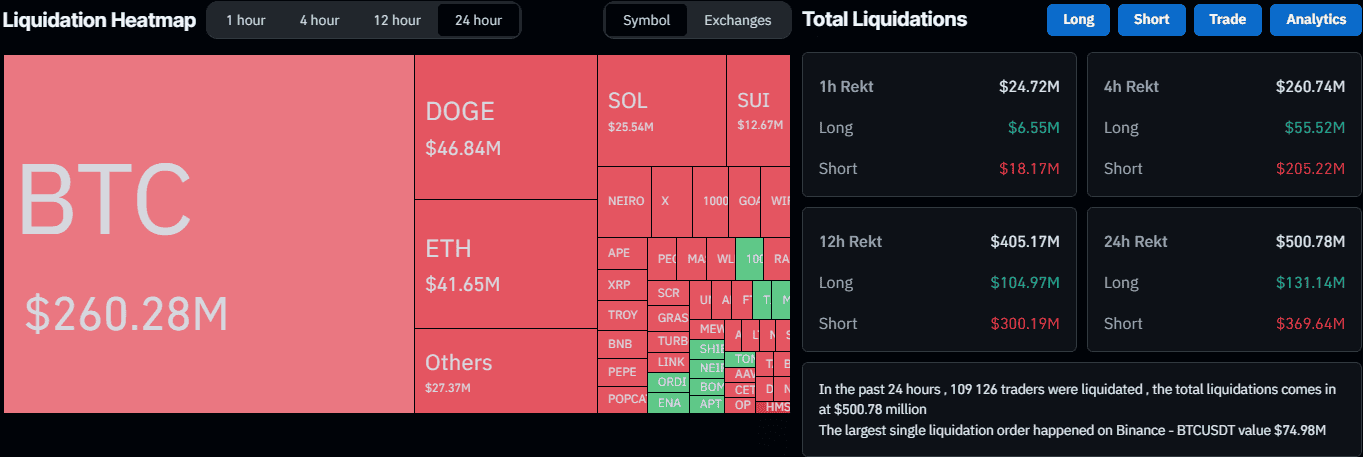

Data from CoinGlass reveals that nearly 110,000 such market participants have been wrecked in the past 24 hours. The total value of liquidated positions is up to $500 million, with short accounting for the lion’s share.

The single-biggest wrecked position was a whopping one. It took place on Binance, involved the BTC/USDT trading pair, and was worth an astonishing $75 million.

Crypto X speculates that it belonged to a big whale who bet against Trump in the elections, and the subsequent surge led to this substantial liquidation.

The post Single Trader Was Liquidated for $75 Million on Binance Amid BTC’s Surge to New All-Time High appeared first on CryptoPotato.